Why memory pricing matters in 2025

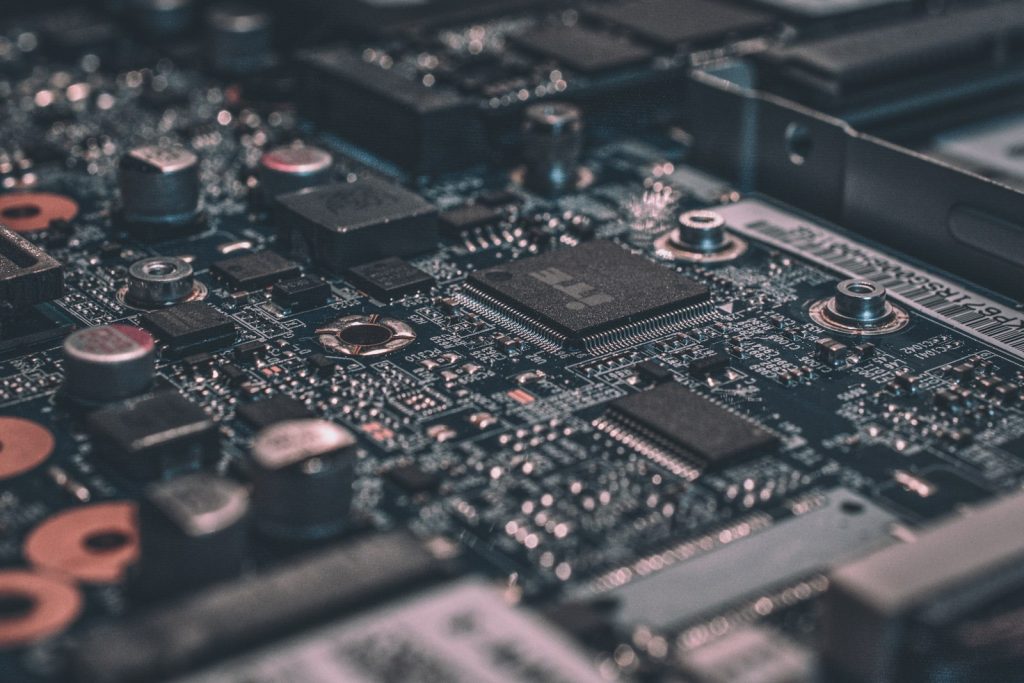

Memory is no longer just a commodity line item. In 2025, it’s become the invisible tax on every AI workstation, every laptop refresh, and every storage upgrade. The collision of AI-server demand, supplier transitions, and inventory discipline has created pricing patterns that defy traditional seasonality.

This guide dissects what’s happening across DRAM, NAND, and HBM—the three memory categories that determine whether your next hardware purchase fits the budget or blows it. If you’re shipping AI workloads, managing a fleet, or just building a creator PC, these numbers affect you directly.

The 2025 pricing snapshot

Memory Market at a Glance

↑ Q3’25

↑ Contract

↑ Allocation

↑ Forecast

Three memory categories, three different stories

Not all memory behaves the same. DRAM (your system RAM), NAND (your SSDs), and HBM (AI accelerator memory) each follow different supply-demand curves. Understanding the distinction is the first step to making smarter procurement decisions.

DRAM: The AI allocation squeeze

System memory—DDR4 and DDR5—is caught between server-side AI demand and consumer upgrade cycles. Vendors are prioritizing DDR5 for servers, which means DDR4 availability is tightening even as prices climb. TrendForce forecasts a 40%+ surge in consumer DDR4 contract prices by late 2025.

NAND: Inventory discipline returns

SSD pricing moves on different rhythms. After aggressive inventory clearance in 2024, suppliers have restored discipline. Expect 5–10% increases in NAND contract prices through Q3 2025, with retail following 4–8 weeks later.

HBM: The AI bottleneck

High Bandwidth Memory is the true constraint for AI accelerators. Every H100 and MI300X depends on HBM capacity, and demand far outstrips supply. TrendForce projects 5–10% price increases in 2025, but the real issue is allocation—not cost.

Contract price forecasts: the visual breakdown

2025 Contract Price Change by Memory Type

The standout: consumer DDR4 leads all categories. The irony is that the “older” memory type is seeing the steepest price action, driven by vendor mix shifts away from legacy products while demand persists.

What’s driving these prices (the real mechanics)

1. AI capacity allocation

HBM consumes high-end packaging and manufacturing attention. When suppliers prioritize HBM for AI accelerators, it pulls engineering and production capacity away from consumer DRAM. This indirect effect explains why PC memory pricing no longer follows predictable seasonality.

2. Product transition timing

The DDR4-to-DDR5 transition is awkward. Vendors are eager to move to higher-margin DDR5, but buyers—especially in emerging markets and budget segments—still need DDR4. When suppliers cut DDR4 allocation faster than demand drops, prices spike.

3. Inventory discipline

After painful 2023–2024 cycles of oversupply and margin destruction, memory vendors have learned their lesson. They’re maintaining tighter inventory levels, which means less cushion when demand accelerates. Retail price swings become more volatile.

4. Contract vs retail lag

Headlines focus on contract prices—what OEMs and large buyers pay. Retail pricing follows with a 4–8 week delay, and the translation isn’t linear. When specific SKUs go out of stock, remaining inventory commands premium pricing.

Memory comparison matrix

| Type | Where You Feel It | 2025 Driver | Your Best Move |

|---|---|---|---|

| DRAM (DDR4/DDR5) | PCs, laptops, servers | Server demand, mix shifts, transitions | Standardize SKUs |

| NAND (SSDs) | Storage refresh, fleets | Inventory discipline, OEM pull | Buy in windows |

| HBM | AI accelerators | AI demand, packaging capacity | Plan early |

Buyer’s playbook by use case

AI Workstations

- Prioritize capacity over timing. Underbuying RAM hurts productivity more than overpaying by 10%.

- Standardize DIMM types across your fleet to reduce scramble-buying when prices spike.

- Track HBM news as a leading indicator for broader memory pressure.

Consumer Upgrades

- Watch transition spikes. DDR4 is spiking because vendors are deprioritizing it.

- Prefer common SKUs from major vendors to reduce markup risk.

- Best ROI: enough RAM plus a good SSD—not peak specs.

Enterprise Fleets

- Buy in planned windows. Waiting can backfire when availability shifts.

- Pre-approve SSD models by workload tier to simplify procurement.

- Keep buffer stock to avoid emergency markups.

Market size context: where the dollars flow

2025 Global Memory Revenue (Projected)

DRAM dominates by revenue, but HBM punches above its weight in strategic importance. The $34B HBM market directly gates AI accelerator availability—making it the highest-impact category per dollar.

Expert perspective

“TrendForce anticipates HBM prices will increase by 5% to 10% in 2025, driven by sustained demand from AI accelerators and limited packaging capacity expansion.”

[1]

Scenario planning for teams

If you manage a product team or an infrastructure budget, the smartest way to handle memory volatility is to turn it into a quarterly process—not a panic reaction.

The policy that works

- Define a floor: minimum RAM/SSD spec per role.

- Define a ceiling: max price before switching to an alternative SKU.

- Revisit quarterly using analyst forecasts as the early warning.

This is the same mindset as cloud spend controls: you don’t predict the market perfectly—you build a system that behaves well under uncertainty.

Signal sources worth tracking

Pricing shifts often appear in supply-chain commentary before they hit retail. These sources offer leading indicators:

- TrendForce / DRAMeXchange: Contract price forecasts and allocation commentary.

- EE Times Asia: Syndicates TrendForce insights with regional context.

- ServeTheHome: YouTube and site coverage on server/AI hardware supply signals.

- Tom’s Hardware: Consumer-facing coverage of memory and SSD retail cycles.

FAQ: fast answers

Will DDR5 get cheaper?

Long-term, yes—new generations normalize. Short-term, transitions create the weirdest pricing, especially when vendors cut older products faster than demand drops.

Should I wait to buy?

If you’re within a planned upgrade window, waiting can backfire. Availability shifts faster than pricing headlines. If you’re not upgrading soon, set alerts and watch next quarter’s signals.

Is HBM only relevant for AI GPUs?

Directly, yes. Indirectly, HBM demand shifts supplier attention across the memory stack. It’s a leading indicator for where the ecosystem is prioritizing margin and capacity.

Key Takeaways

- Memory is now an AI allocation story. HBM pressure ripples into consumer DRAM and SSD pricing.

- DDR4 is spiking, not fading. Vendors are deprioritizing it while demand persists—creating 40%+ price surges.

- Buy on capacity needs, not timing. The productivity cost of underbuying usually exceeds the savings from market-timing.

- Build procurement policies. Standardize SKUs, define price ceilings, and revisit quarterly.

- Track HBM as a leading indicator. It correlates with broader memory ecosystem pressure.

Sources

- [1] TrendForce, “HBM Market Poised for Robust Growth Amid Surging AI Demand,” May 2024. [Online]. Available: https://www.trendforce.com. [Accessed: Dec. 2025].

- [2] TrendForce, “DRAM and NAND Flash Contract Prices to Rise in 3Q25,” July 2025. [Online]. Available: https://www.trendforce.com. [Accessed: Dec. 2025].

- [3] EE Times Asia, “TrendForce forecasts over 40% surge in consumer DDR4 prices,” Aug. 2025. [Online]. Available: https://www.eetasia.com. [Accessed: Dec. 2025].

- [4] Yole Développement, “HBM Revenue Forecast 2025,” 2024. [Online]. Available: https://www.yolegroup.com. [Accessed: Dec. 2025].